Understanding the Property and Inland Marine Coinsurance Clause

A “coinsurance clause/condition” is found in many commercial insurance policies, but the term “coinsurance” is often a difficult concept to understand. Coinsurance is referenced in property and inland marine coverage, as well as health insurance, but its use is entirely different depending on the context. For this purpose, the focus will be as it relates to property and inland marine coverage.

The coinsurance clause is an “insurance to value clause” for the policy holder. Because of the insurance mechanism of pooling collected premium dollars to pay for future losses in the insurance industry, the purpose of the coinsurance clause is to create fairness in premiums among policy holders.

Some policy holders understand that the probability of a partial loss is greater than a total loss. In contrast, others choose to insure for a total loss, despite it being a lower probability. In standard property premium development, the premium rate is applied to the insured limit to arrive at the property premium. The collected premiums are used for the payment of property losses. The result? Policy holders who choose to insure for a total loss are shouldering a higher percentage of any property loss compared to those who insure their property only up to the more probable partial loss limit.

A coinsurance condition/clause in a property policy typically requires the covered property to be insured to a specified percent (80%, 90%, or 100%) of its loss valuation at the time of loss. If a partial loss occurs, and the property has not been insured to the specified percent, the insurer can reduce their loss payment by the percent of what the property should have been insured for, minus the deductible.

For example:

- The current 100% value of the covered building = $200,000

- The required “coinsurance” percentage = 80%

- The required limit of insurance = $160,000

- The actual insured limit = $100,000

- Deductible = $2,500

- Actual Partial Loss = $50,000

- Coinsurance Calculation – [($100,000 ÷$160,000) X $50,000] - $2,500 = $28,750 loss payment.

In the above example, if the covered property had been insured to the required coinsurance percentage (80%), the loss payment would have been $47,500 ($50,000 loss minus the $2,500 deductible) – and the insured would have avoided an $18,750 payment reduction.

There is a lot to consider regarding coinsurance, and the minimum required coinsurance may vary by line of coverage. Being aware of – and understanding – coinsurance provisions in your coverage is very important. Contact the AssuredPartners Agribusiness team to discuss your coverage options.

Featured News & Insights

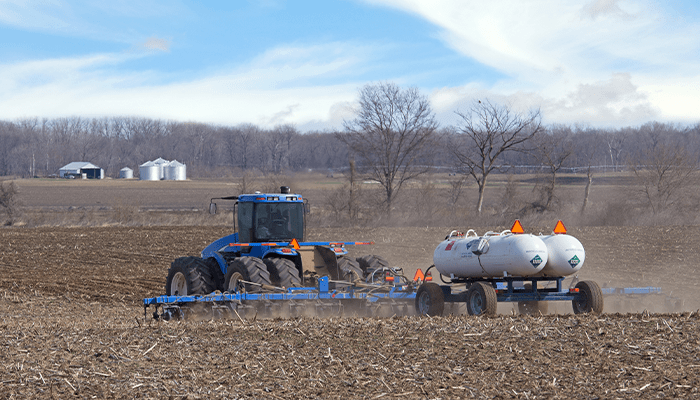

Nitrogen is the cornerstone of crop production, vital to plant health and growth. However, one of the most efficient yet challenging sources of nitrogen is anhydrous ammonia (NH3). While NH3 is an...

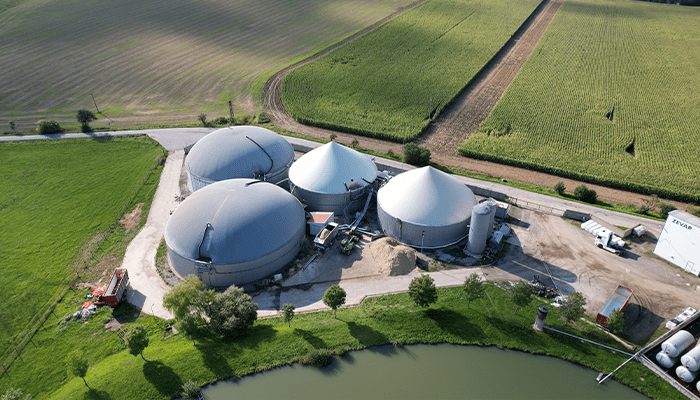

Carbon credits as a concept have been around for years, offering both environmental and economic opportunities for the agriculture sector. With sustainable practices taking center stage, it's...

The outlook for the U.S. poultry market is promising as demand remains high, flock populations have recovered, and market prices are expected to increase, according to the USDA’s August 2024...