Education Insurance Products & Services

Solutions designed specifically for educational institutions

At its core, the foundation of the AssuredPartners Education team is straightforward—the better job we do together as risk managers, the fewer claims you will have. Fewer claims mean more insurers will want your business, which leads to the real payoff—a safer environment for your community, better insurance coverage, and ultimately more attractive premiums for your school.

The services and products we offer as part of our Education Insurance plans are the backbone our valued relationships with our school clients. These services and products include:

To us, losses and claims are about more than just the financial cost; they are about the students, faculty, and staff they affect. Each loss has some adverse effect on your people, so we’re keenly focused on helping you predict exposures and gaps and prevent unfavorable outcomes. Our approach includes:

- Performing campus risk assessments to identify, assess (heat map), and develop a plan to mitigate strategic, financial, operational, organizational, and reputational risks.

- Maximizing insurance company loss control and risk management resources in the most effective way possible.

- Joining safety committees to add value and provide support for the work a school is already doing.

- Collaborating with schools to develop and implement general risk transfer guidelines, review draft contracts, and check the acceptability of others’ certificates of insurance

- Hosting Risk Management Forums, connecting industry professionals, and sharing valuable and timely information with our school clients.

Our extensive database allows us to develop valuable insurance and risk management benchmarks so clients can easily compare themselves to their peers. These benchmarks include common coverages, insurance rates, limits, deductibles, and property replacement cost values.

Placing a complex insurance program for an educational institution is not a once-a-year project but an ongoing, real-time process. By regularly evaluating a school’s program, we strive to eliminate last-minute renewal decisions and significantly reduce our clients’ renewal paperwork requirements, leaving you more time to focus on your students, faculty, and staff.

The renewal process outlined below reflects a comprehensive client-centric approach, resulting in joint planning, timely decision-making, and typically no surprises.

- Scheduling pre-renewal meetings five to six months before your policy effective date.

- Preparing budget projections based on your budget cycle.

- Securing options so we are never caught off guard by drastic changes from your existing carriers.

- Reducing renewal workload for you to minimize time spent.

- Presenting the marketing results when all the initial underwriter quotes are in and the negations on your behalf are complete.

- Delivering your policy electronically after a thorough review by our in-house quality control team.

- Maintaining a summary of insurance and updating it as required, showing the coverages, terms, conditions, deductibles, and premiums.

Our exceptional in-house claims team has experience with various catastrophic losses and minor yet stressful events on school campuses. Our institutional knowledge, continuous professional training, strong relationships with insurance carriers, and internal partnerships set us apart from our peers.

Educational institutions that offer travel abroad programs for students and faculty understand all too well how quickly a well-organized international trip can go awry. Foreign travel, even in the safest countries, comes with a great deal of risk for your school.

We designed our Foreign Travel Insurance and Assistance program to help schools with their travel programs before departure with pre-trip planning and to provide world-class emergency response if something goes wrong while students and faculty are away.

It’s not uncommon for you to open up your school campus for a special event. Whether it’s a school-sanctioned occasion, a private function hosted by an alumnus, or you rented space to a local nonprofit, community group, or a local business, ensuring you have the proper coverage to protect your school from liability is essential.

AssuredPartners has developed a special insurance program to help schools cover the inherent risks involved in these short-term endeavors. Our online portal makes it easy for educational institutions or event providers to quickly quote, review, and pay for Special Event Coverage, streamlining the process significantly.

Helping our K-12 independent schools protect students and their families is a primary concern for the Education Insurance team. One of the many ways we do this for our independent schools is by helping students and their families manage personal financial risk with Tuition Refund Insurance.

One of the aspects that makes our program different is that it includes Tuition Continuance Coverage. While most coverages are triggered by a withdrawal, in the event of a job loss or death of a tuition payer, students can have their claims paid without having to withdraw from school and continue to stay enrolled for the remainder of the year.

Featured News & Insights

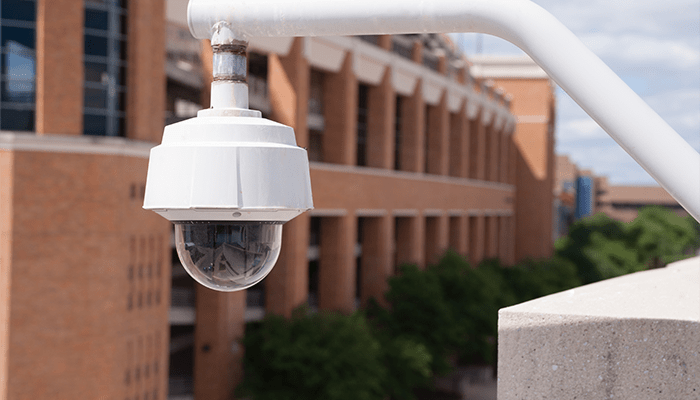

Surveillance cameras have become a critical component of many schools' safety and security plans. Just by their mere presence on a campus, video cameras often help deter criminal activity, harassing...

From service dogs and emotional support animals (ESAs) to your run-of-the-mill four-legged friends, boarding schools, colleges, and universities continue to field an increasing number of requests...

There appear to be endless opportunities for cutting-edge technologies, like generative artificial intelligence (AI) and virtual/augmented reality (VR/AR), to facilitate teaching and support learning...