Importance of Soft Cost and Rental Value Coverages in Construction Projects

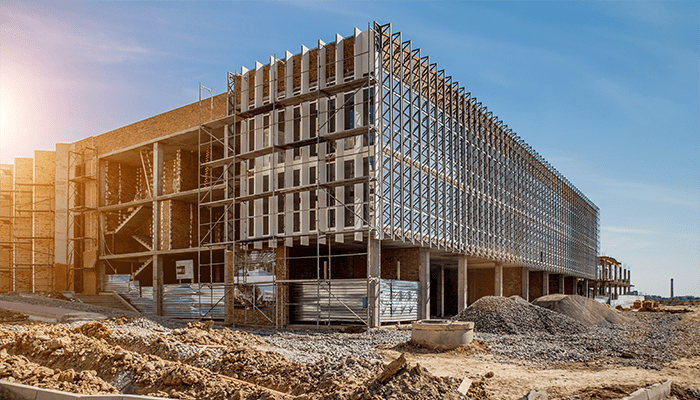

On a large construction project, so much attention is spent on evaluating the third-party aspect of the risk, particularly in areas where heavy construction defect litigation is prevalent. However, managing and transferring risk with first-party exposure is equally important to safeguard financial investments and ensure project completion. One critical aspect often overlooked is the importance of soft cost and rental value coverages, especially concerning additional named insureds. Soft costs, which can include expenses such as legal fees, architectural costs, and profit/overhead, can significantly escalate in the event of a project delay or unforeseen incident.

In a recent case discussed by the Insurance Risk Management Institute (IRMI), coverage for these soft costs and rental values was denied for an additional named insured. This scenario underscores the necessity for builders to meticulously review and understand their insurance policies, ensuring that such coverages are not only included but also extended to cover additional named insured parties. Without proper coverage, construction projects are vulnerable to financial strain, potentially jeopardizing the entire undertaking. As an advisor, it's essential to highlight these risks and work with clients to tailor comprehensive builders risk policies that address both direct and indirect project costs, ensuring robust protection against potential disruptions.

An effective risk management strategy involves more than just understanding potential vulnerabilities; it requires proactive measures and expert guidance to ensure comprehensive coverage. Our construction team is well-versed in builders' risk insurance and stands ready to assist you in navigating these complexities. We are committed to partnering with you to develop policies that include essential soft cost and rental value coverages, safeguarding your project from unexpected financial burdens.

Don't leave your project exposed to unnecessary risks. Contact our construction team today to discuss how we can help you secure the right builders' risk insurance, ensuring your investment is protected every step of the way.

Featured News & Insights

In construction, most things are done with precision and planning. So why are so many contractors still skipping written contracts with their subs? If you’re responsible for your company’s insurance...

The construction insurance market is seeing shifts that will impact contractors in the year ahead. Some lines of coverage remain stable, while others are facing increased scrutiny from carriers....

When it comes to construction, safety is always priority number one. You already know that personal protective equipment (PPE) is a must to keep your team safe from hazards on the job. But here’s...