What Realtors Need to Know About Home Insurance

In the dynamic landscape of real estate, a relationship with a knowledgeable professional for home insurance is indispensable for realtors aiming to provide their buyers and sellers with the best possible experience during the transaction. A well-chosen policy not only safeguards a client’s investment but also enhances the realtor’s reputation whether you’re guiding first-time home buyers or working with seasoned investors. Here’s how you can ensure your clients are properly protected with a quality homeowners insurance solution.

What Home Insurance Covers

Home insurance is designed for property and liability protection of your most valuable asset, covering unexpected events and natural disasters such as fire, lightning, windstorms, falling objects and other accidental losses. It’s essential to recognize that it’s not a catch-all solution. Regular maintenance and responsible homeownership measures should be taken to avoid future damage. As your clients undergo home inspections, it’s important to note that homeowners' insurance is not a warranty. It is very unlikely a home policy will cover wear and tear, maintenance or damage caused by negligence.

The Significance of Location

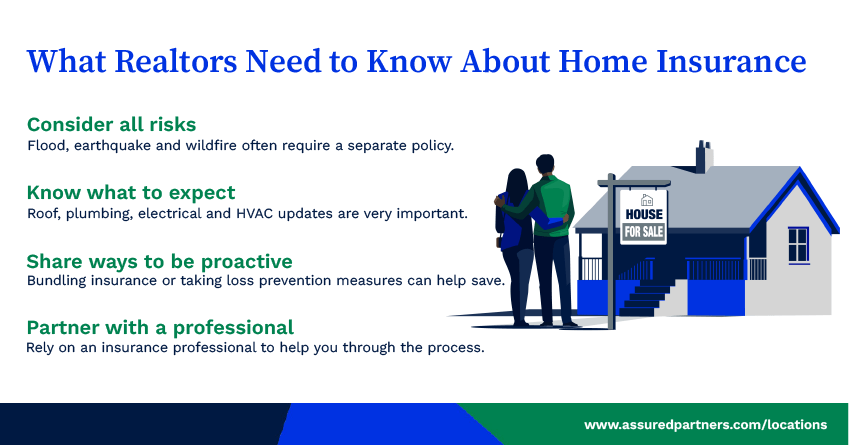

Depending on where your client’s future home is located can impact which types of insurance coverage and policies they should have in place. Standard home insurance does not include flood, earthquake, or wildfire and often a separate policy is needed. Even if the home isn’t near a body of water, weather patterns are continuously changing with the increase of convection storms throughout the country. According to USAFacts, more than 75% of national flood insurance payouts have occurred since 2002. This should be on your client’s radar when selecting coverage.

Pay Attention to the Details

As a realtor, understanding what items can help or cause issues when obtaining home insurance for your client can help your process go much smoother. “Having a reliable insurance resource offers invaluable peace of mind by ensuring you have access to expert guidance and the right coverage to protect your assets. It simplifies navigating the complex insurance landscape, helping you make informed decisions and providing a safety net for unforeseen events,” says Monica Santiago, Director of Marketing/Business Development and Insurance Agent.

Insurance companies are focused on reviewing the home’s roof, plumbing, electrical and HVAC system. An ideal 4-point inspection will not have any hazards listed. Examples can include visible signs of leaks or HVAC systems unable to produce heat. Most insurance companies will require the roof’s condition to have a minimum three-year life expectancy and the HVAC and water heaters need to be less than 20 years old. Wind mitigation inspections are good for five years and are recommended to obtain on replaced roofs or roofs older than 15 years.

Ways to Save on Home Insurance

There are a variety of offerings clients can investigate that can potentially lower the cost of home insurance. Wind mitigation inspections, alarm certificates, gated communities, accredited builders and bundling options can all play a role in discounting home insurance policies. The installation of devices like Ting for fire prevention and water leak detection systems can also result in savings for home buyers. Insurance brokers represent several companies, helping guide you and your clients on ways to save and offering options with one or more providers.

Empower Your Clients by Working with an Insurance Agent

Your clients should feel good about their new purchase and understand what’s covered in their policy. Having the right insurance partner can make all the difference in the quality of their experience. Find a location and let’s work together so you can close with confidence. We’re successful when our clients are successful, and we understand the power of partnership better than anyone else.

Related articles

Personal umbrella coverage, also referred to as excess liability coverage, protects beyond your underlying insurance policy limits. While we can’t always foresee accidents, we can set ourselves up...

We have an abundance of options at our fingertips for just about everything we can purchase. Finding insurance companies with a good reputation and quality service is important to many of us. In...

You’ve probably seen the commercials to bundle your home and auto with specific insurance companies, but did you know you can customize your options when you use a broker? You have policies for the...